Trustees of affected trusts need to understand the new reporting obligations, assess whether the required information is readily available, and plan to obtain the necessary details to ensure compliance for trust taxation years ending on or after December 31, 2023.

Under the new reporting rules, Trusts are required to report the identity of all trustees, beneficiaries, and settlors of the trust, along with each person who has the ability (through the trust terms or a related agreement) to exert control or override trustee decisions over the appointment of income or capital of the trust (e.g., a protector). Reporting of this additional information will be required along with an annual T3 Trust Return in 2023 and future years. The new requirements are a considerable change from the current rules and carry significant penalties for non-compliance.

IMPORTANT:

The new reporting requirements apply to inactive and/ or dormant trusts. Even if you have never filed before, you must file in 2023 or significant penalties could result.

The new rules are also intended to apply to “bare trust arrangements”. If you participate in an arrangement where property is on title with a nominee but beneficial ownership resides elsewhere please let us know.

With the changes going into effect in the next tax year, this means that 2022 is your final opportunity to wind-up or change the terms of your trust to avoid these expanded reporting requirements. A wind-up or change in your Trust still requires a trust filing.

ACTION REQUIRED:

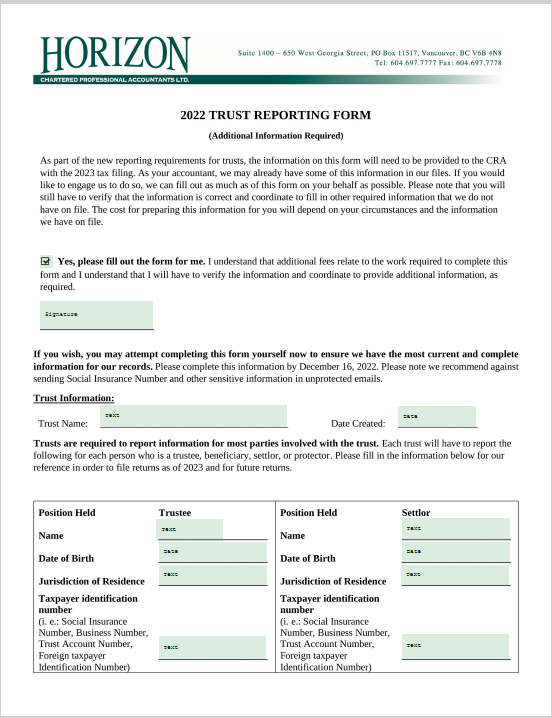

Linked here is a Trust Reporting Form we require you to complete and return to us at your earliest convenience, but no later than February 1, 2023, in order to give us the opportunity to prepare for your filings. This is especially important if you wish to wind-up or make changes to your trust for the year ended December 31, 2022.

Please let us know if you would like to engage us to prepare as much of this supplementary information form as we can with the information we already have on file. The cost for preparing this information for you will depend on your circumstances and the information we have on file.

Summary of New Rules for Trust Taxation years ending on or after December 31, 2023

- All Trusts will be required to file T3 return even if there is no income to report.

- Each year additional information must be reported with respect to all trustees, beneficiaries, settlors, and each person who has the ability to exert control or override trustee decisions over the appointment of income or capital of the trust (e.g., a protector). The information that must be disclosed are:

- Names

- Addresses

- Dates of birth

- Jurisdiction of residences

- Taxpayer identification numbers (such as social insurance number, trust account number, business number, foreign taxpayer identification number.)

- In case of Family Trusts, they will need to be transparent with respect to all possible beneficiaries, even contingent beneficiaries, of the trust, as well as making annual trust filings in years where there is no distribution of income or capital.

Exceptions

There are exceptions to the new reporting requirements, including:

- Trusts that have been in existence for less than three months;

- Trusts that hold assets not exceeding $50,000 in total fair market value throughout the year not including any private company shares or real estate;

- Certain regulated trusts, such as a lawyer’s general trust account;

- Trusts that qualify as non-profit organizations or registered charities;

- Mutual fund trusts, segregated funds, and master trusts;

- Graduated rate estates;

- Qualified disability trusts;

- Employee life and health trusts;

- Certain government funded trusts;

- Trusts under or governed by certain registered plans; and

- Cemetery care trusts and trusts governed by eligible funeral arrangements.

Penalties

If there is a failure to file a trust return in 2023 (even if there was no activity) and future years, the penalty for failure to file is the greater of:

- $2,500 plus interest or,

- 5% of the highest total fair market value of the property held by the trust.

In addition, existing penalties in respect of T3 returns continue to apply. The penalty for the failure to file a T3 return is $25 per day with a minimum of $100 and can increase up to $2,500.

Ready to submit your information?

Linked below is a fillable Trust Reporting Form to be filled in with the required information we need to file your trust’s T3. Once filled and signed, a copy will be sent to us electronically. You will need to provide an email address to confirm your signature.

If you are the trustee of multiple trusts, please fill out a separate form for each trust and identify the trust in the line provided. You may use the same email address more than once when submitting this form.

If you would like us to fill the form on your behalf, please check the box in the form and sign the document. To reduce your costs you may fill in as much of the form as you are able to. If you wish to keep a copy of the completed form, please download the form after submission.