Do you have taxes owing, installments, or a payroll remittance due? We’ve created a step-by-step instruction sheet on how to set up this payment using the following options below:

Note: As of January 1, 2024, if your payment amount to the CRA is more than $10,000, it must be made as an electronic payment. Check this article out for more details: Changes to Payments to the Receiver General of Canada – Horizon CPAs

Option 1: Pre-authorized debit (pAD)

1

To use this method, you must create a CRA My Account or My Business Account.

Click here for instructions:

How to Register for CRA’s My Business Account – Horizon CPAs

How to Register for CRA’s My Account (Individuals) – Horizon CPAs

2

Once you have logged into your CRA account, select the “Proceed to Pay” button under Accounts and payments category

4

Access ‘Manage pre-authorized debit’ under the Related services within the Accounts and payments section to view, modify, cancel, or skip a payment.

5

You set the payment amount and authorize the Canada Revenue Agency (CRA) to withdraw it from your Canadian chequing account on the date, or dates, you choose.

6

Your selected first payment date must be at least five business days from the date your PAD agreement is created.

Important to note: Business representatives are unable to create a PAD through ‘Represent a client’ on behalf of their client. The PADs payment option is only available through My Business Account or My Account.

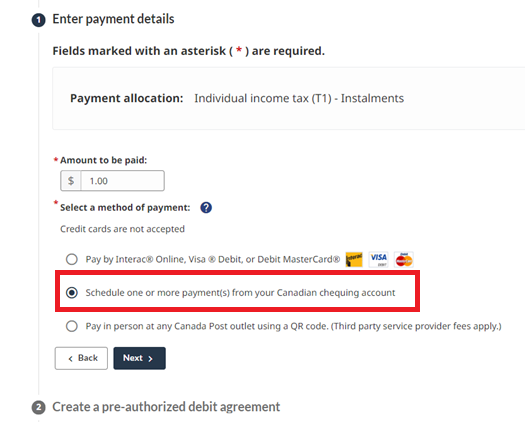

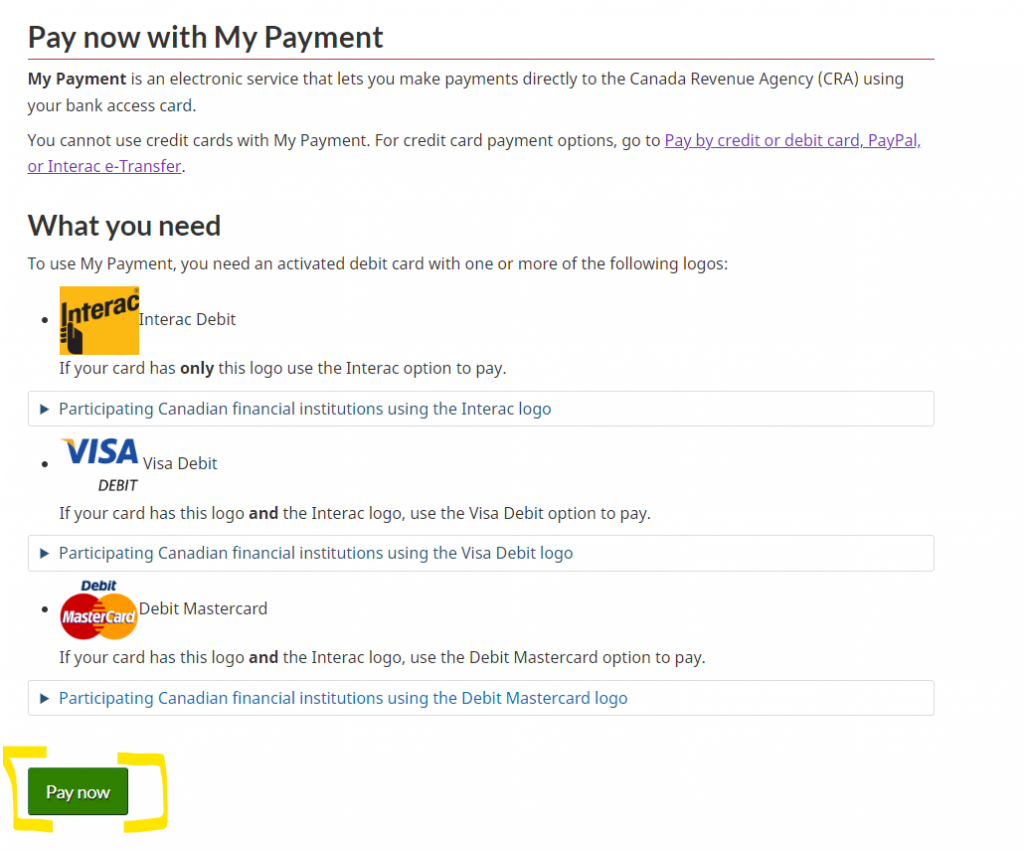

Option 2: CRA Online payment

3

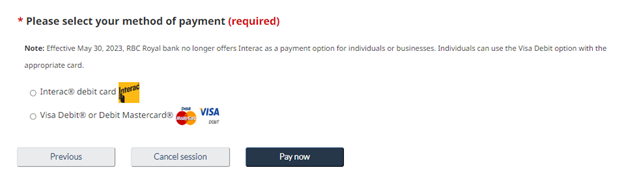

Select payment allocation. You can pay with Visa Debit, Debit Mastercard, or Interac Online.

5

Proceed to pay

Effective May 30, 2023, RBC Royal bank no longer offers Interac as a payment option for individuals or businesses. Individuals can use the Visa Debit option with the appropriate card.

6

Once completed, you will be redirected back to the CRA My Payment website and a confirmation receipt will be displayed.

Option 3: Online Banking

For Individuals

1

Sign in to your financial institution’s online banking service for individuals.

2

Under “Add a payee” look for an option such as:

- CRA (revenue) – YEAR tax return

- Use this option to make a payment for the current year’s tax return.

- CRA (revenue) – tax amount owing

- Use this option to make a payment for any amount owing, as shown on your notice of assessment / reassessment, on your statement of account, remittance voucher, or in letters issued by the Canada Revenue Agency.

- CRA (revenue) – tax instalment

- Use this option to make payments towards the next year’s tax instalment

- CRA (revenue) – Canada emergency benefit repayment

- Use this option to repay COVID-19 benefits: Canada emergency response benefit (CERB) with the CRA, Canada emergency student benefit (CESB), Canada recovery benefit (CRB), Canada recovery caregiving benefit (CRCB), Canada recovery sickness benefit (CRSB), or Canada worker lockdown benefit (CWLB).

3

Enter your 9-digit social insurance number as your CRA account number. Make sure the number is accurate so that the CRA can apply your payment correctly.

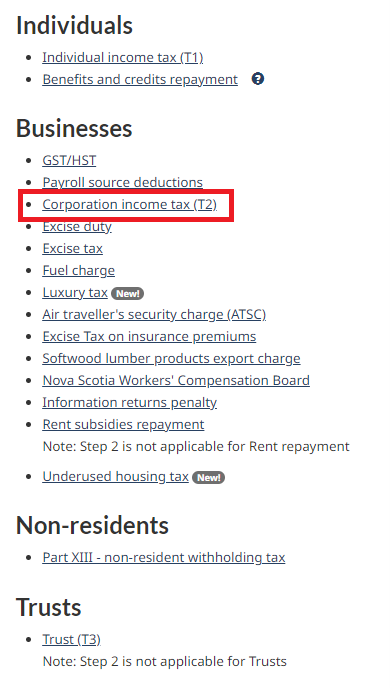

For Businesses

1

Sign in to your financial institution’s tax filing service or online banking service for businesses. Some financial institutions require their clients to sign up for a business bank account in order to make business payments. Please check with your financial institution if you require assistance.

2

Select the tax payment type and select an option such as:

- Federal – Corporation Tax Payments – TXINS

- Federal – GST/HST Payment – GST-P (GST-P)

- Federal Payroll Deductions – Regular/Quarterly – EMPTX – (PD7A)

- Federal Payroll Deductions – Threshold 1 – EMPTX – (PD7A)

- Federal Payroll Deductions – Threshold 2 – EMPTX – (PD7A)

- Federal – Canada emergency wage subsidy repayment

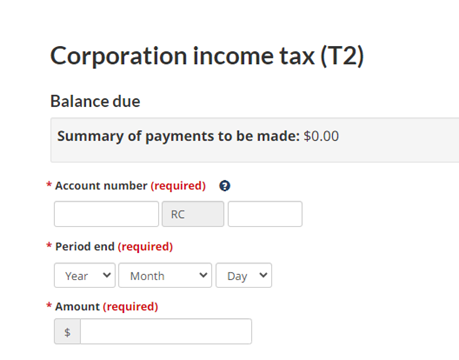

3

Follow the instructions which would include entering your 15-digit business number as your CRA account number. The ending letters and numbers will need to be added as follows:

- “RC0001” – Corporate Taxes

- “RP0001” – Payroll Taxes

- “RT0001” – GST Taxes

Make sure the number is accurate so that the CRA can apply your payment correctly.

When you make a payment, your financial institution’s online banking app or website will display the date your payment was made. Payments are usually received by the CRA within 5 business days. To avoid fees and interest, please make sure you pay on time.