Latest News

Bare Trusts: Proposed new reporting requirements you need to know

You’ll be required to file a tax return for Bare trusts under the New Trust Filing Requirements. Failure to comply with the new reporting rules may result in potentially significant penalties, including the new gross negligence penalty. If enacted, the new trust reporting rules will apply to trusts with tax […]

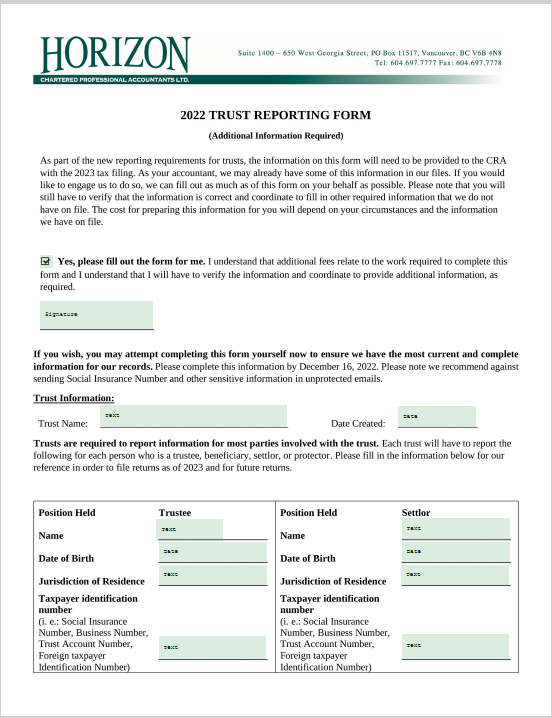

New T3 Trust Filing Requirements

Trustees of affected trusts need to understand the new reporting obligations, assess whether the required information is readily available, and plan to obtain the necessary details to ensure compliance for trust taxation years ending on or after December 31, 2023. Under the new reporting rules, Trusts are required to report […]

Make a Tax Payment Using CRA’s Online Portal

Do you have taxes owing, installments, or a payroll remittance due? We’ve created a step-by-step instruction sheet on how to set up this payment using the following options below: Note: As of January 1, 2024, if your payment amount to the CRA is more than $10,000, it must be made as an […]