Tag: Tax news

New for 2023 – BC Renter’s Tax Credit

Starting in the 2023 tax year, a $400 tax credit is available to individuals who pay rent and occupied a rental unit in B.C. under a tenancy agreement, licence, sublease agreement or similar arrangement for at least six one-month periods. For the 2023 tax year, the maximum renter’s tax credit […]

Changes to Payments to the Receiver General of Canada

We’re writing to inform you about an important update regarding your payments or remittances to the Receiver General of Canada. What’s Changing? As of January 1, 2024, if your payment amount to the Receiver General of Canada is more than $10,000, it must be made as an electronic payment. This […]

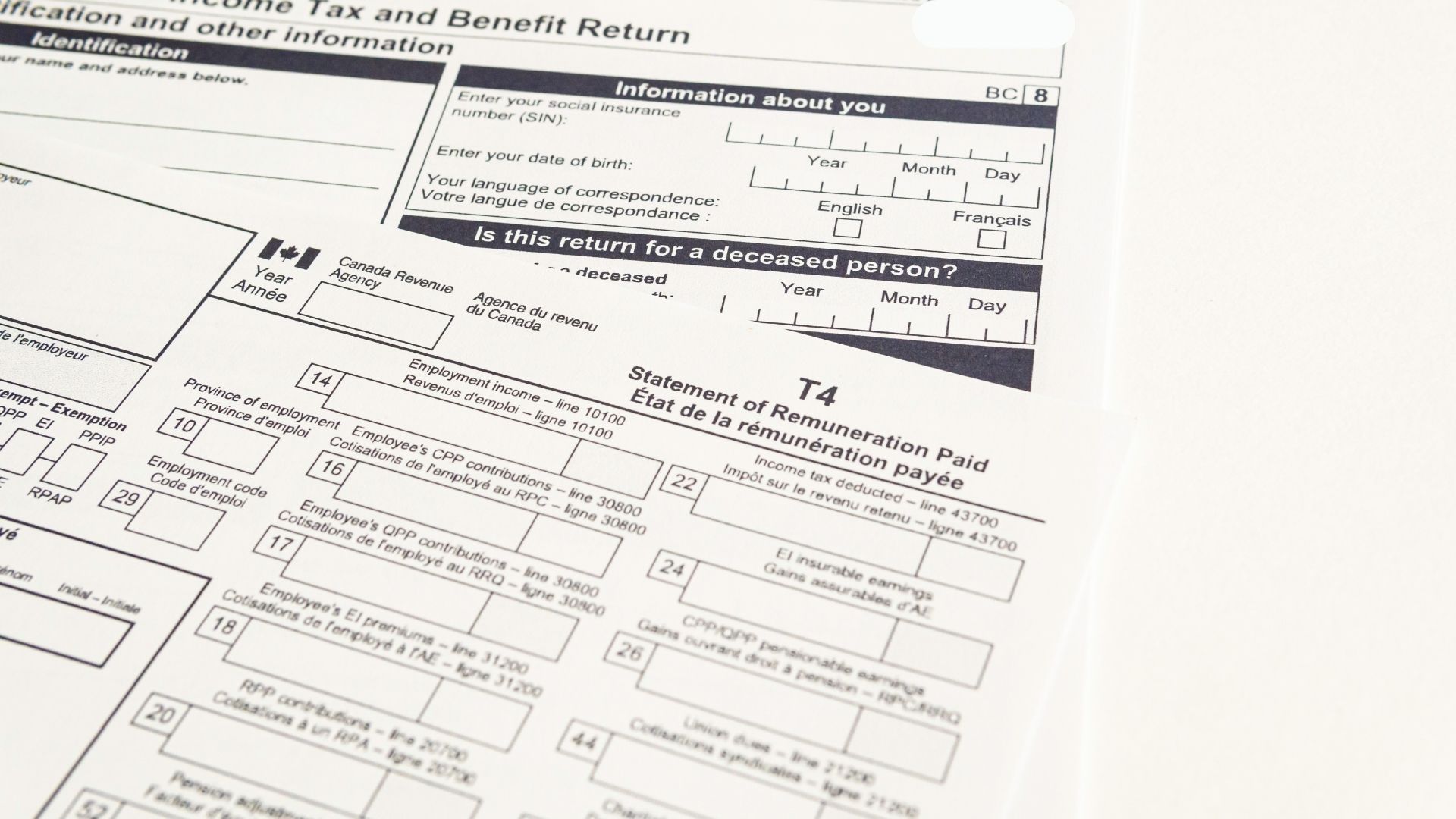

Update on T4 Slip Requirements for 2023

We would like to bring to your attention an important update regarding the T4 slip requirements for the calendar year 2023 and onwards. New Requirement It is now mandatory for employers to indicate whether an employee or any of their family members were eligible, as of December 31 of that […]