Author: Jared Behr

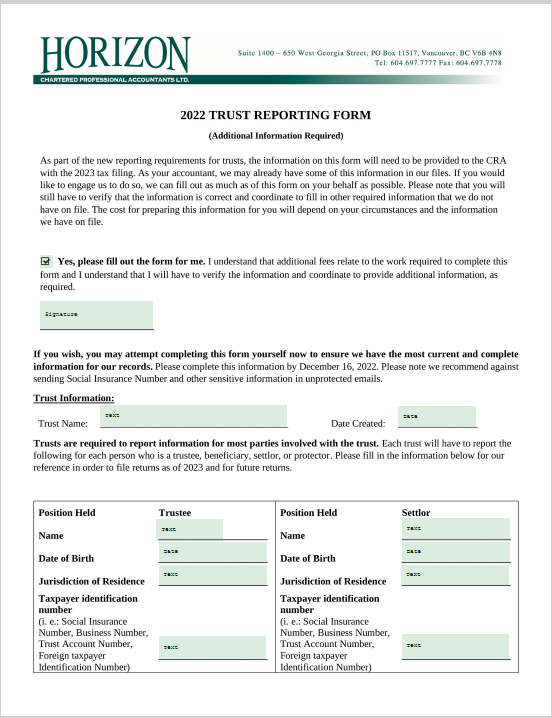

New T3 Trust Filing Requirements

Trustees of affected trusts need to understand the new reporting obligations, assess whether the required information is readily available, and plan to obtain the necessary details to ensure compliance for trust taxation years ending on or after December 31, 2023. Under the new reporting rules, Trusts are required to report […]

COVID-19: April 1 – Updated Federal and Provincial Response for Small Businesses and Entrepreneurs

Each day new measures of economic relief are being announced by the government. Unfortunately, not all of the economic relief measures have been formalized yet and so we are often short on details. We appreciate your patience with us as we respond to your questions with available information and help you through […]

Updates to Personal Tax Deadlines

Dear Clients We are closely monitoring the evolving situation regarding the coronavirus (COVID-19). Last week the Federal Government announced the following measures in regards to the tax deadlines for Canadians: The tax filing deadlines have been extended: Personal: extended to June 1, 2020 (previously April 30th) Trusts: extended to May […]